A 100-mile stretch of coral reef in Mexico is now insured just like any other valuable asset. Is this the future of conservation?

Broken coral branches1

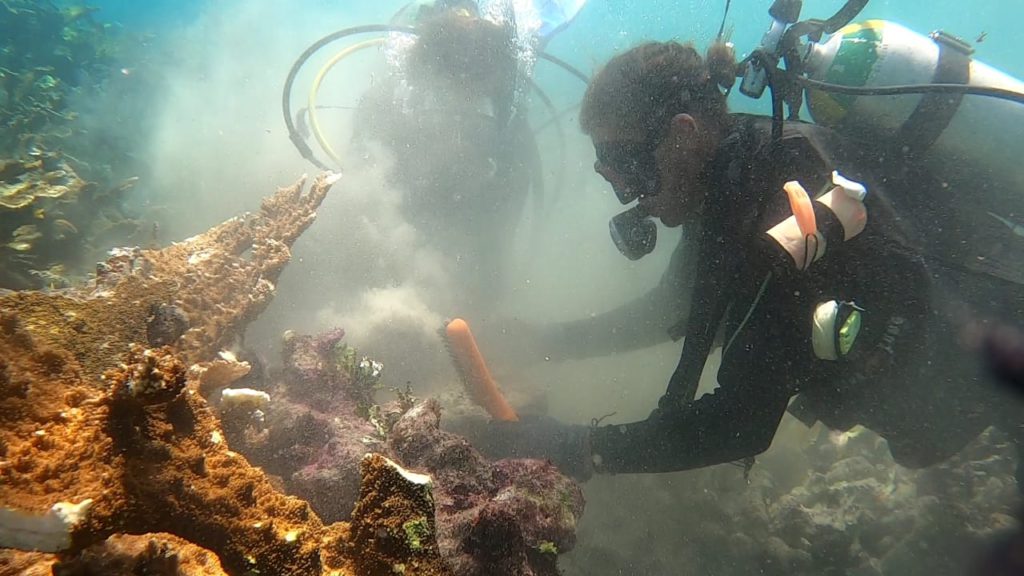

Collecting coral fragments1

Coral nursery

When hurricane Delta hit the coast of Mexico on 7th October 2020, experts reckoned that repairing and replanting the ravaged coral colonies of the Mesoamerican Reef (MAR) and the coastline around Quintana Roo south of Cancun could cost about USD $800,000. Rapid response was critical as broken coral dies within weeks. But government funding, predictably, could take much longer to materialise. Conservationists and local businesses alike realised that the cost of not repairing the battered reef would be greater than the cost of restoring it, as the Mesoamercian Reef is second in size only to Australia’s Great Barrier Reef and home to 500 types of fish, 70 different corals, sea turtles and whale sharks. Yet, 80 percent of the living coral along Mexico’s Caribbean coast has been lost or degraded in the past 40 years due to pollution, overfishing, disease and increasingly extreme weather events. A simple and cost-effective solution came to their rescue: insurance.

A pioneering nature-based insurance policy purchased in 2019 by the Quintana Roo state government in conjunction with environmental NGO The Nature Conservancy (TNC) funded the efforts of Guardians of the Reef, a group of 80 trained snorkelers, fishermen, biologists, even local restaurant staff led by local diver Emanuel Quirago. They stabilised 1,200 affected coral colonies and removed storm debris from the beaches within 11 days. They also rescued and transplanted almost 9,000 broken coral fragments in artificial nurseries until they could be reattached to the seabed to regenerate new coral colonies. The work is ongoing and the guardians are poised to respond to future storm events if necessary.

Preparing to uplift a big colony

Uplifing an overturned colony

The funds for the insurance policy came from the Coastal Zone Management Trust, set up by the state government with support from TNC and revenues were paid by beachfront property owners and hoteliers. A parametric insurance policy like this involves calculating pre-specified payouts depending on various potential trigger events – in this case, the payout varies according to wind strength. The restoration of these coral reefs, which attract over a million snorkelers and divers annually, has ecological and commercial benefits. Healthy reefs absorb 97 percent of each wave’s energy so they buffer the coast against storm damage and provide nurseries for breeding fish.

Fixing small coral colonies

Fixing coral colony

Recently fixed colony

“Insurance plus government commitments paired with on-the-ground rapid response create the perfect formula to quickly repair critical coral reefs,” says Fernando Secaira, Mexico’s climate risk and resilience lead for The Nature Conservancy. TNC was able to enlist the participation of local businesses by making them aware that the health of this fragile coastal ecosystem was intrinsically linked to their economic success. “It’s a win-win and we look forward to identifying other parts of the world where this approach could work,” he says. They are exploring the feasibility of insuring reefs in regions like the Caribbean, Central America and Asia. Studies show that insurance policies like this could help protect coral reefs against natural disasters – perhaps to protect Florida reefs from future hurricanes and coral in Hawaii from marine heatwaves or coral bleaching.

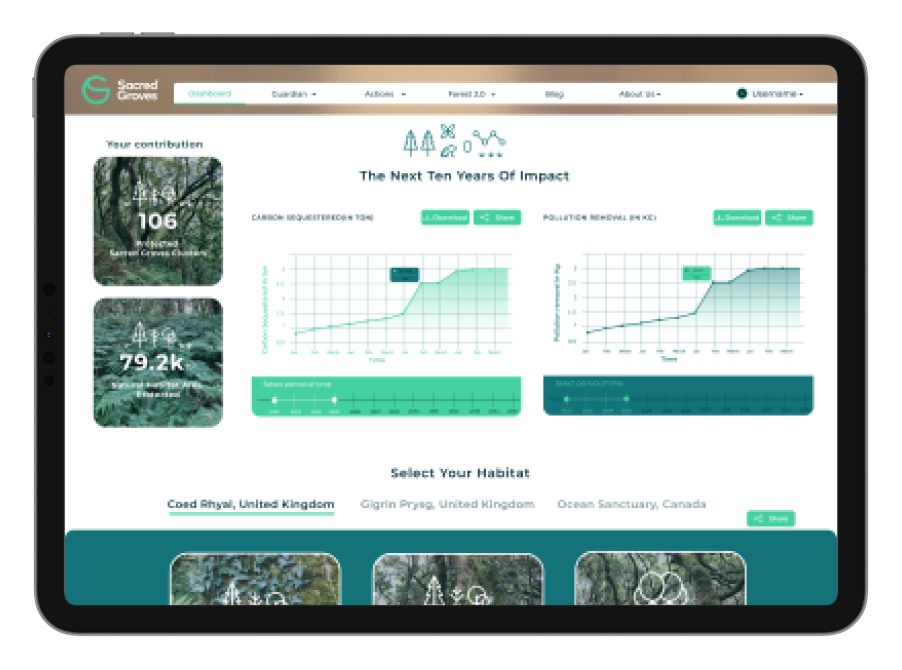

Nature advocate and CEO of US-based fintech company Cultivo Dr Manuel Piñuela believes that this parametric insurance for nature-based projects will grow over the coming years: “We see innovation around insurance and reducing risk as a critical component to unlock investment into nature.”

Author: Anna Turns, The India Story Agency for Sacred Groves

Images Credit: 1. Daniela Zambrano The Nature Conservancy, all others The Nature Conservancy

Did you enjoy this article?

Share with friends to inspire positive action.